Bitcoin’s price journey has been a rollercoaster, marked by periods of explosive growth, sharp declines, and consistent volatility. This analysis delves into the factors driving these fluctuations, examining both short-term price predictions and long-term trends. We’ll explore the relationship between Bitcoin and the broader cryptocurrency market, highlighting the influence of macroeconomic forces and regulatory changes.

Understanding Bitcoin’s price trend requires a nuanced perspective, considering the interplay of technical indicators, news events, and market sentiment. This analysis provides a comprehensive overview of the historical data, current dynamics, and potential future trajectory of Bitcoin’s value.

Bitcoin Price Movement Overview

Bitcoin’s price journey has been a rollercoaster, marked by periods of explosive growth, sharp declines, and significant volatility. Understanding these trends requires examining the historical data and the underlying factors influencing its price. This overview provides a comprehensive look at Bitcoin’s price movement, its key drivers, and its long-term trajectory.Bitcoin’s price is heavily influenced by market sentiment, regulatory developments, and technological advancements.

The cryptocurrency market, in general, is highly susceptible to speculative activity and news events, which often translate into dramatic price swings.

Historical Price Trend

Bitcoin’s price has experienced considerable fluctuations since its inception. Early adoption saw gradual price increases, followed by periods of substantial growth and subsequent corrections. The volatility has been a constant feature, making it a risky investment but also one with the potential for substantial gains.

- Early Adoption (2009-2012): Bitcoin’s price started from near zero and slowly gained traction. This early phase saw a gradual increase, though the overall price remained relatively low.

- Early Bull Run (2013-2014): A significant surge in Bitcoin’s price marked this period, reaching notable highs. The market experienced significant speculation and investor interest, but this bull run was followed by a sharp decline.

- Consolidation and Volatility (2015-2020): Bitcoin’s price experienced a period of consolidation, with periods of both growth and decline. Market sentiment fluctuated significantly, often influenced by regulatory changes and technological developments.

- Recent Bull Run (2020-Present): The recent years have seen another substantial bull run, with Bitcoin’s price reaching new all-time highs. Factors such as increased institutional adoption, positive market sentiment, and technological advancements contributed to this trend.

Influencing Factors

Numerous factors have influenced Bitcoin’s price fluctuations. These factors can be broadly categorized into market sentiment, regulatory developments, technological advancements, and macroeconomic conditions.

- Market Sentiment: Investor confidence and public perception play a crucial role. Positive news or events often trigger price increases, while negative news or regulatory concerns can lead to price drops. Examples include social media trends and mainstream media coverage.

- Regulatory Developments: Governments worldwide are developing regulations for cryptocurrencies. These regulations can either foster confidence or create uncertainty in the market, affecting the price. The SEC’s stance on Bitcoin ETFs, for instance, can influence the price.

- Technological Advancements: Innovations in Bitcoin’s underlying technology and associated ecosystems can affect the price. Upgrades, new features, or the emergence of new applications can boost confidence and price. The introduction of Layer-2 solutions, for example, can improve the network’s scalability and increase its appeal.

- Macroeconomic Conditions: Global economic events, such as interest rate changes, inflation, and geopolitical instability, can significantly affect Bitcoin’s price. The correlation between Bitcoin and the stock market, for example, shows a relationship influenced by macroeconomic trends.

Bitcoin Price Data

The following table presents Bitcoin’s price (USD) on specific dates, highlighting yearly highs and lows.

| Date | Bitcoin Price (USD) |

|---|---|

| 2010-01-03 | 0.0001 |

| 2021-11-10 | 67,000 |

| 2022-06-18 | 20,000 |

| 2023-10-27 | 26,000 |

Long-Term Price Trajectory

Predicting Bitcoin’s long-term price trajectory is inherently complex. While Bitcoin has shown the potential for substantial growth, its volatility remains a significant consideration. Future price movements will likely depend on various factors, including regulatory clarity, technological advancements, and macroeconomic conditions.

Impact of Macroeconomic Factors

Macroeconomic conditions can significantly impact Bitcoin’s price. For example, during periods of economic uncertainty or high inflation, Bitcoin can be viewed as a hedge against traditional assets. However, a strong economic recovery could also lead to a reduction in Bitcoin’s appeal.

Relationship with Other Cryptocurrencies

Bitcoin’s price often correlates with the prices of other cryptocurrencies. When Bitcoin experiences a surge, other cryptocurrencies often see similar increases. Conversely, declines in Bitcoin can trigger declines in other cryptocurrencies. The relationship between these assets is often complex and interconnected.

Short-Term Price Prediction Factors

Short-term Bitcoin price predictions rely heavily on a combination of technical indicators, news events, and social sentiment. Analyzing these factors allows traders to identify potential price movements and make informed decisions. Understanding the interplay between these elements is crucial for successful short-term trading strategies.

Technical Indicators Affecting Bitcoin Price

Technical indicators provide insights into Bitcoin’s price movements based on past trading data. These indicators, such as moving averages, relative strength index (RSI), and volume, offer a framework for assessing potential trends and identifying support and resistance levels. For instance, a rising moving average often suggests an uptrend, while a sharp decline in volume might signal a weakening trend.

Careful consideration of multiple indicators is key to forming a comprehensive picture of the market’s direction.

News Events and Social Media Sentiment in Price Swings

News events, including regulatory announcements and significant developments in the cryptocurrency space, can significantly impact Bitcoin’s short-term price. Social media sentiment, reflected in discussions and opinions about Bitcoin, also plays a critical role. Positive news or a surge in positive sentiment can trigger price increases, while negative events or opinions can lead to downward pressure. The combined influence of news and social media often creates volatile price movements that traders must navigate.

Recent Significant Events Impacting Bitcoin’s Price

Several recent events have impacted Bitcoin’s price. These include regulatory discussions in key jurisdictions, significant advancements in blockchain technology, and major market events such as the collapse of certain crypto firms. These events can influence the market’s perception of Bitcoin’s value and lead to price fluctuations.

Regulatory Changes and Their Influence on Short-Term Price Action

Regulatory changes, such as new laws or stricter enforcement, can dramatically affect Bitcoin’s short-term price. These changes can either increase or decrease investor confidence, leading to either a positive or negative price reaction. The uncertainty surrounding regulations often contributes to volatility in the market.

Comparison of Trading Strategies During Short-Term Price Movements

Various trading strategies are employed by traders during short-term price movements. These strategies include day trading, swing trading, and scalping, each with its own set of risks and rewards. Day traders aim to profit from short-term price fluctuations within a single trading day. Swing traders capitalize on medium-term price movements lasting several days or weeks. Scalpers, on the other hand, exploit small price changes, aiming for quick profits.

Short-Term Price Predictions Based on Technical Analysis

The following table presents a simplified example of short-term price predictions based on technical analysis. These predictions are illustrative and should not be considered financial advice. Note that various technical indicators and their thresholds would need to be considered in a real-world scenario.

| Date | Technical Indicator | Prediction | Rationale |

|---|---|---|---|

| 2024-10-26 | Moving Average Crossover | Slight Upward Trend | Short-term bullish signal. |

| 2024-10-27 | RSI Oversold | Potential Reversal | RSI suggests potential price increase. |

| 2024-10-28 | Volume Decrease | Possible Consolidation | Decreased volume may indicate a pause in the trend. |

Long-Term Price Trend Analysis

Bitcoin’s long-term price trajectory is a complex interplay of technological advancements, adoption rates, and market sentiment. While predicting the precise future price is impossible, analyzing historical patterns and underlying drivers provides a framework for understanding potential long-term trends. This analysis considers crucial factors shaping Bitcoin’s future, from technological innovations to institutional involvement and potential obstacles.Understanding Bitcoin’s long-term price movement necessitates a nuanced approach that goes beyond short-term fluctuations.

Historical data, combined with an evaluation of underlying forces, paints a more complete picture of the cryptocurrency’s potential future.

Technological Advancements Influencing Long-Term Growth

Bitcoin’s underlying blockchain technology, while foundational, is not static. Continuous development and innovation in areas like scalability, security, and transaction speeds can significantly impact its long-term viability and user adoption. Improvements in transaction throughput, for instance, could make Bitcoin more competitive with traditional payment systems, potentially driving price appreciation.

Adoption and Integration into Mainstream Finance

The integration of Bitcoin into mainstream financial systems is a key driver of its long-term price. Increased acceptance by businesses, financial institutions, and everyday consumers translates to greater utility and demand. The growing presence of Bitcoin in institutional portfolios and investment strategies demonstrates this trend. Examples of institutional adoption include certain investment firms including Bitcoin in their portfolios, signaling a growing acceptance of the asset class.

Factors Potentially Hindering Long-Term Growth

Several factors could impede Bitcoin’s long-term price appreciation. Regulatory uncertainty remains a significant concern. Government regulations, both positive and negative, can dramatically impact market sentiment and trading activity. For instance, regulatory restrictions or outright bans in specific jurisdictions can limit the asset’s accessibility, thereby potentially dampening demand. Furthermore, security breaches and vulnerabilities in the Bitcoin network can erode investor confidence and affect the price.

This can manifest as a loss of trust, similar to the impact of security breaches on other financial assets.

Impact of Institutional Investment

Institutional investment plays a critical role in influencing Bitcoin’s long-term price trend. The entrance of large institutional players into the market signifies a move towards greater legitimacy and acceptance. This can lead to increased liquidity and trading volume, positively impacting the price. Large institutional investors often bring substantial capital to the table, which can significantly influence market dynamics.

For example, the inclusion of Bitcoin in the portfolios of prominent investment funds can signal a shift in market sentiment, potentially leading to price appreciation.

Consequences of Technological Advancements in the Cryptocurrency Space

The cryptocurrency landscape is dynamic, and advancements in other cryptocurrencies or blockchain technologies could impact Bitcoin’s future. Competitors may emerge, offering alternative solutions that capture market share and demand. These new entrants might offer superior features, like faster transaction speeds or improved security. The emergence of competing technologies can create a challenge for Bitcoin’s dominance, which could potentially impact its long-term value.

Consider the emergence of Ethereum, which has influenced the cryptocurrency landscape and attracted significant attention.

Cryptocurrency Market Context

The cryptocurrency market is highly interconnected, and Bitcoin’s price often reflects the overall sentiment and performance of other cryptocurrencies. Factors like regulatory developments, technological advancements, and overall market confidence can significantly influence the entire ecosystem. Understanding this interconnectedness is crucial for assessing Bitcoin’s potential future movements.The performance of other cryptocurrencies significantly impacts Bitcoin’s price. When altcoins (alternative cryptocurrencies) experience a surge in popularity or adoption, it can sometimes lead to increased investment in Bitcoin as well, potentially boosting its price.

Conversely, a downturn in the altcoin market can negatively impact investor confidence in the entire cryptocurrency space, potentially leading to a decrease in Bitcoin’s value. This correlation isn’t always direct, but it often exists.

Major Crypto Events and Market Impact

Major events in the cryptocurrency space, such as significant regulatory announcements, large-scale hacks, or the launch of new blockchain technologies, can trigger substantial price fluctuations across the board. For instance, regulatory changes in key jurisdictions can impact investor sentiment and trading activity, affecting not just Bitcoin but the entire market. The 2017 ICO boom, followed by the subsequent downturn, is a prime example of a market-wide event influencing prices.

Comparison of Cryptocurrency Performance

Bitcoin’s performance is often compared to other significant cryptocurrencies, like Ethereum, XRP, and Litecoin. These comparisons can highlight similarities and differences in price movements and market trends. Sometimes, similar price trends across different cryptocurrencies can indicate broader market trends, while diverging trends can point to specific issues affecting one particular cryptocurrency.

Factors Influencing Cryptocurrency Prices

Several factors influence the price movements of various cryptocurrencies. These include investor sentiment, media coverage, technological advancements, regulatory developments, and market speculation. For example, positive news regarding a specific cryptocurrency or a technological advancement in its underlying blockchain can lead to increased investor interest and a price increase. Conversely, negative news or regulatory concerns can cause a decline.

Market Capitalization and Trading Volume Comparison

The table below provides a snapshot of the market capitalization and trading volume for Bitcoin and other significant cryptocurrencies, as of a specific date. Comparing these metrics provides a quantitative understanding of the relative importance and liquidity of each cryptocurrency in the market. This data is dynamic and changes frequently.

| Cryptocurrency | Market Capitalization (USD) | 24-Hour Trading Volume (USD) |

|---|---|---|

| Bitcoin | [Value] | [Value] |

| Ethereum | [Value] | [Value] |

| XRP | [Value] | [Value] |

| Litecoin | [Value] | [Value] |

| [Other significant cryptocurrency] | [Value] | [Value] |

Factors Influencing Price Volatility

Bitcoin’s price exhibits significant volatility, a characteristic that often surprises newcomers to the cryptocurrency market. Understanding the underlying forces driving these fluctuations is crucial for both investors and traders. This section delves into the key factors that contribute to Bitcoin’s price swings, examining the impact of speculation, regulatory uncertainty, media coverage, and algorithmic trading.

Speculation and Market Sentiment

Market sentiment plays a pivotal role in Bitcoin’s price movements. Positive sentiment, fueled by favorable news or perceived future growth, can drive up the price. Conversely, negative sentiment, triggered by concerns about regulatory changes or market downturns, can lead to significant price drops. The psychology of the market, often fueled by speculation and herd behavior, can significantly amplify or dampen price fluctuations.

Examples of this include the 2017 Bitcoin bull run, largely driven by investor optimism, and the subsequent market correction that followed.

Regulatory Uncertainty

Government regulations significantly impact the cryptocurrency market, including Bitcoin. Ambiguity surrounding regulatory frameworks, such as tax laws and licensing requirements, can create uncertainty and apprehension among investors. This uncertainty often leads to increased volatility, as investors react to perceived threats or opportunities. For instance, differing interpretations of regulations across jurisdictions can result in price fluctuations as investors adjust their strategies in response to the evolving legal landscape.

News and Media Coverage

News and media coverage can significantly influence investor sentiment and, consequently, Bitcoin’s price. Positive news stories, such as successful adoption by major companies, often boost investor confidence and lead to price increases. Conversely, negative news, including security breaches or regulatory concerns, can trigger substantial price drops. The speed and intensity of media coverage can also amplify these price movements, with widespread reporting often creating a ripple effect in the market.

Algorithmic Trading

Algorithmic trading strategies play a significant role in Bitcoin’s price volatility. High-frequency trading, for example, employs sophisticated algorithms to execute trades at extremely fast speeds, often reacting to small price changes. This can create a self-reinforcing feedback loop, where algorithms trigger price fluctuations that, in turn, trigger further algorithm-driven trades. These automated trading strategies can influence price volatility, sometimes causing sudden and substantial price swings.

Correlation Between Factors and Price Fluctuations

| Factor | Impact on Bitcoin Price | Example |

|---|---|---|

| Speculation and Market Sentiment | Positive sentiment leads to price increases; negative sentiment leads to price drops. | Positive news about Bitcoin adoption by a major corporation leads to price increase. |

| Regulatory Uncertainty | Ambiguity and concerns about regulations lead to price volatility. | Unclear tax laws for cryptocurrency trading can lead to price drop due to investor uncertainty. |

| News and Media Coverage | Positive news boosts price; negative news triggers price drops. | Reports of a major security breach in a Bitcoin exchange lead to price decrease. |

| Algorithmic Trading | High-frequency trading algorithms can create sudden and substantial price swings. | Algorithms react to small price changes, potentially triggering a large sell-off or buy-up. |

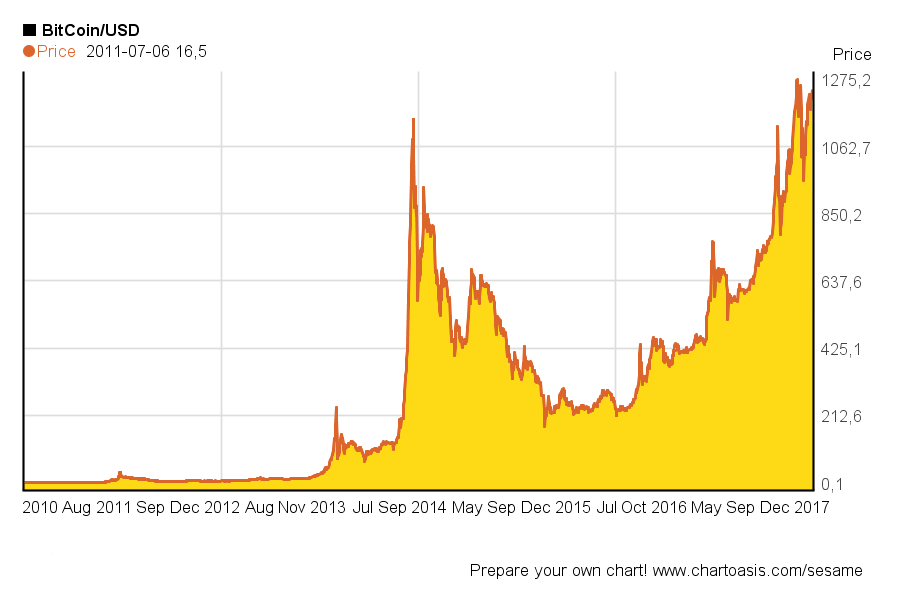

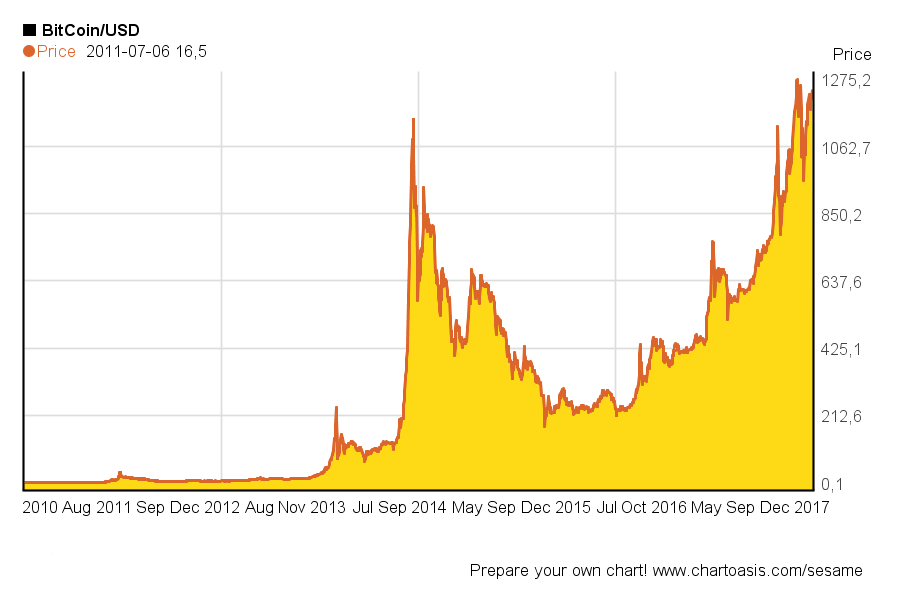

Illustrative Historical Price Charts

A visual representation of Bitcoin’s price journey provides valuable insights into its market dynamics. Historical charts, spanning from 2010 to the present, showcase the dramatic fluctuations and long-term trends that have shaped the cryptocurrency. These charts reveal the interplay of factors, from technological advancements to market sentiment, that have driven Bitcoin’s price.Examining these charts allows us to identify critical turning points, understand the underlying forces impacting the market, and potentially recognize patterns that might suggest future price movements.

Analyzing historical data, while not a perfect predictor, can illuminate potential market reactions to similar events or conditions.

Bitcoin Price Chart (2010-Present)

The Bitcoin price chart, spanning from 2010 to the present, exhibits a pattern of significant volatility and several distinct phases. The initial years displayed extremely low prices and slow growth, reflecting the nascent stage of the cryptocurrency market. Subsequent years saw periods of explosive growth, followed by substantial corrections, illustrating the high-risk nature of this investment.

Key Price Movements and Trends

The chart reveals distinct periods of price appreciation and decline. Early periods show slow, incremental growth. A notable period of rapid increase occurred around the late 2017 and early 2018 period. More recently, the chart displays more sustained periods of consolidation and sideways movement, reflecting a maturation of the market. The graph also illustrates the prevalence of significant price fluctuations that are characteristic of the cryptocurrency market.

Significant Events and Price Changes

Major events often correlate with noticeable price changes. For instance, the emergence of major Bitcoin exchanges, advancements in blockchain technology, regulatory developments, and periods of heightened investor interest often coincided with substantial price increases. Conversely, periods of market uncertainty, regulatory concerns, or negative news about Bitcoin can lead to significant price drops. These correlations underscore the influence of external factors on the Bitcoin market.

Support and Resistance Levels

Support and resistance levels, visualized on the chart, are crucial in understanding the market’s psychology. These levels represent price points where the demand and supply forces are balanced. The chart will display historical support levels that have been tested and broken, along with resistance levels that have been tested but not yet broken. These points help predict future price movements and market sentiment.

Market Sentiment and External Factors

The overall market sentiment, as reflected in the price chart, is one of high volatility and uncertainty. The chart illustrates the influence of various external factors, including technological advancements, regulatory actions, and media coverage. For example, periods of positive news about Bitcoin and advancements in related technologies are typically followed by upward price trends. Conversely, periods of regulatory uncertainty or negative press frequently coincide with downward trends.

This illustrates how the Bitcoin market reacts to external forces.

Closure

In conclusion, Bitcoin’s price trend is a complex interplay of various factors, from technological advancements to macroeconomic shifts. While short-term predictions are inherently uncertain, a long-term perspective reveals a fascinating dynamic. This analysis offers a framework for understanding the factors influencing Bitcoin’s price and its place within the broader cryptocurrency market. The future remains uncertain, but this exploration provides valuable insights for informed decision-making.

Q&A

What is the impact of institutional investment on Bitcoin’s long-term price?

Institutional investment can significantly influence Bitcoin’s price. Increased participation from large financial institutions can lead to greater demand and price appreciation, but it can also introduce volatility if these investments are withdrawn or adjusted.

How do regulatory changes affect Bitcoin’s short-term price?

Regulatory uncertainty often creates short-term price fluctuations in Bitcoin. Changes in regulations, or even the perceived threat of change, can cause traders to react, potentially driving up or down the price.

What is the relationship between Bitcoin’s price and the overall cryptocurrency market?

Bitcoin’s price often mirrors the overall cryptocurrency market’s performance. Significant events in the broader crypto space, such as major launches or regulatory announcements, can influence Bitcoin’s price direction.

How do historical price charts help us understand Bitcoin’s price trend?

Historical price charts offer valuable insights into Bitcoin’s past price movements. They reveal patterns, trends, and the impact of external factors on the price, enabling better understanding of current and future price action.