Bitcoin, a revolutionary cryptocurrency, has gained immense popularity. This guide walks you through the process of buying Bitcoin and sending it to Cash App, a popular mobile payment platform. We’ll cover various buying methods, platform specifics, and crucial security considerations.

Navigating the world of cryptocurrency can be daunting. This comprehensive guide provides a step-by-step approach to ensure a smooth and secure experience, from initial purchase to final transfer.

Introduction to Bitcoin Buying

Bitcoin is a decentralized digital currency, operating independently of central banks and governments. It leverages cryptography for security and transparency, making transactions secure and verifiable. Its value fluctuates based on supply and demand in the market, a key characteristic to understand before investing. Buying and selling Bitcoin involves navigating exchanges, where individuals can trade cryptocurrencies like Bitcoin for fiat currencies (like USD) or other cryptocurrencies.Understanding the process of buying and selling Bitcoin is crucial for navigating the cryptocurrency market.

This involves comprehending how different exchanges operate and the factors that influence Bitcoin’s price. Key considerations include fees, security measures, and user experience.

Bitcoin Buying Process

Understanding the process of acquiring Bitcoin is crucial for anyone looking to participate in the cryptocurrency market. It’s a multi-step procedure, typically involving creating an account on a cryptocurrency exchange and making a deposit. The following steps provide a basic Artikel.

- Choose a reputable Bitcoin exchange. Consider factors like security measures, transaction fees, and user experience.

- Create an account on the chosen exchange. This usually involves providing personal information and verifying your identity. Security is paramount, so ensure the exchange employs robust security measures.

- Fund your account with fiat currency. This is usually done via bank transfer or other methods. Verification processes will differ based on the exchange and your location.

- Place an order to buy Bitcoin. You can choose from different order types, like market orders or limit orders. Each has implications for the price at which you buy.

- Confirm the transaction. Once the order is placed, it’s essential to verify the transaction details before confirming.

Comparison of Bitcoin Exchange Platforms

Comparing different platforms is important for selecting the best option. Features like fees, security measures, and user experience vary significantly.

| Platform | Fees | Security | User Experience |

|---|---|---|---|

| Coinbase | Generally moderate fees, with variations based on transaction type | Robust security measures, including multi-factor authentication and cold storage | User-friendly interface, suitable for beginners |

| Binance | Generally lower fees, but can vary based on transaction volume and type | High security standards, with advanced security features | More complex interface, better for experienced users |

| Kraken | Competitive fees, potentially lower than Coinbase | Strong security record, employing advanced security protocols | User interface is generally considered intuitive and easy to use. |

| Gemini | Competitive fees, generally moderate | High security measures, with a focus on security and compliance | User-friendly interface, suitable for both beginners and experienced users. |

Note: Fees, security measures, and user experience are subject to change. Always review the latest information on each platform.

Methods for Buying Bitcoin

Purchasing Bitcoin involves several methods, each with its own set of advantages and disadvantages. Understanding these options is crucial for making informed decisions and mitigating potential risks. This section details various methods for acquiring Bitcoin, including the common approaches and their associated trade-offs.

Bank Transfers

Bank transfers are a traditional method for transferring funds, and they can be used to buy Bitcoin from exchanges. This method is generally secure when used with reputable exchanges that have robust security protocols in place. However, the speed of transactions can vary depending on the bank and the exchange’s processing times.

- Pros: Often seen as a reliable option for larger transactions, and it is a common method for many users.

- Cons: Can be slower than other methods, potentially taking several business days to complete, and sometimes may incur fees from the bank or exchange.

- Security: Security depends heavily on the exchange’s security measures and the user’s vigilance in safeguarding their account credentials. Using strong passwords and enabling two-factor authentication is crucial. Never share your login details with anyone.

Credit/Debit Cards

Credit and debit cards are widely used for purchasing Bitcoin. They offer convenience and relatively quick transactions. However, they are also associated with potential risks.

- Pros: Fast and convenient, allowing for immediate purchases, and suitable for smaller transactions.

- Cons: Higher transaction fees are often associated with this method compared to other options. There’s also the potential for fraudulent activity or unauthorized charges.

- Security: The security of this method relies on the security measures of the exchange or platform you use. Always choose reputable platforms with robust security measures, and ensure your payment information is protected.

Peer-to-Peer (P2P) Transactions

P2P transactions allow users to buy Bitcoin directly from other users. This method offers potentially lower fees and greater control over the transaction. However, it’s crucial to prioritize safety and verify the identity of the seller.

- Pros: Potentially lower transaction fees compared to using exchanges, and allows for greater control over the transaction process.

- Cons: Higher risk of scams and fraudulent activities due to the direct nature of the transaction, and it’s essential to thoroughly research and verify the identity of the seller.

- Security: Users must be cautious and thoroughly verify the seller’s identity. Never send funds to strangers without proper identification and verification. Using reputable P2P platforms can mitigate risks.

Transaction Costs and Timeframes

| Payment Method | Transaction Costs | Typical Timeframe |

|---|---|---|

| Bank Transfers | Variable, depending on bank and exchange fees | 2-5 business days |

| Credit/Debit Cards | Usually higher than bank transfers, including exchange and card network fees | Immediate or near-immediate |

| P2P Transactions | Potentially lower than exchanges, but can vary significantly | Variable, depending on the agreement between buyer and seller |

Buying Bitcoin on a Specific Platform

Choosing a reputable platform like Coinbase or Kraken is crucial for secure Bitcoin purchases. These platforms provide a structured environment for transactions, facilitating user interaction and ensuring a streamlined process. They offer various features, including secure storage, different order types, and typically lower fees compared to other methods.

Creating an Account and Verifying Identity

Account creation on platforms like Coinbase and Kraken typically involves providing personal information, including name, email address, and phone number. This information is essential for verifying your identity. Security measures are paramount on these platforms, and rigorous verification procedures are in place to prevent fraudulent activities. These measures protect both the platform and its users.

- Account creation typically involves filling out a form with your personal information, including name, email, and phone number.

- Identity verification often requires uploading documents like a government-issued photo ID and proof of address. This helps ensure the account belongs to the legitimate user.

Funding Your Account

Several payment methods are commonly accepted for funding Bitcoin accounts. The platform’s acceptance of various payment methods makes it accessible to a broader range of users. This often includes bank transfers, credit/debit cards, and sometimes even wire transfers.

- Common funding methods include bank transfers, credit/debit cards, and sometimes wire transfers. Each platform may have specific requirements or limitations.

- Be sure to review the platform’s terms and conditions regarding payment methods and any associated fees. Understand these policies to avoid any unexpected charges.

Placing an Order for Bitcoin Purchases

Once your account is funded, you can place an order to buy Bitcoin. The process varies slightly depending on the chosen platform, but generally involves specifying the amount of Bitcoin you wish to purchase and the price you’re willing to pay. Order types available on the platform allow for different levels of control over the transaction.

- Specify the amount of Bitcoin you want to purchase and the price you’re willing to pay.

- Review your order carefully before confirming to avoid any mistakes.

Order Types

Different order types offer varying levels of control over the price and execution of your Bitcoin purchase. Understanding these types helps you tailor your order to your investment strategy.

| Order Type | Description |

|---|---|

| Market Order | Executes the order immediately at the current market price. |

| Limit Order | Enters an order to buy or sell at a specific price or better. |

| Stop-Limit Order | Combines a stop-loss order with a limit order. This ensures a minimum price for execution. |

The choice of order type depends on your individual investment goals and risk tolerance.

Sending Bitcoin to Cash App

Sending Bitcoin to Cash App is a common practice for users looking to access their digital assets through a mobile payment platform. This process typically involves transferring Bitcoin from a designated Bitcoin exchange to your Cash App wallet. Understanding the steps and associated risks is crucial for a secure and smooth transaction.Transferring Bitcoin from a cryptocurrency exchange to Cash App requires careful navigation of both platforms.

The exchange will likely have specific instructions for initiating the transfer, and Cash App will require verification and confirmation steps. It’s important to ensure the recipient address is correct to prevent errors and potential loss of funds.

Transferring Bitcoin from a Bitcoin Exchange

Initiating a Bitcoin transfer from a Bitcoin exchange to Cash App necessitates adhering to the exchange’s specific procedures. This often involves generating a Bitcoin address unique to the Cash App account. Crucially, double-checking this address is essential to prevent misdirected transfers.

Security Measures in Bitcoin Transfers

Security is paramount when transferring Bitcoin. Employing strong passwords and enabling two-factor authentication (2FA) on both your exchange account and Cash App is strongly advised. Regularly reviewing transaction history and promptly reporting any suspicious activity is also vital. Furthermore, using a secure internet connection during the transfer process significantly reduces the risk of unauthorized access.

Step-by-Step Guide to Sending Bitcoin to Cash App

This detailed guide Artikels the common process:

- Locate the “Bitcoin” or “Cryptocurrency” section within your Bitcoin exchange platform.

- Select the option to send Bitcoin to an external wallet address.

- Input the unique Bitcoin address associated with your Cash App account. Verification of this address is critical.

- Enter the amount of Bitcoin you intend to transfer.

- Review the transaction details, ensuring the correct amount and address are confirmed.

- Authorize the transaction on your Bitcoin exchange platform.

- Monitor the transaction status within your Bitcoin exchange platform until the transfer is confirmed.

- Check your Cash App wallet to confirm the Bitcoin balance.

Potential Risks and Limitations

Several potential risks and limitations accompany Bitcoin transfers to Cash App. A crucial risk is human error, such as mistyping the recipient address, which can lead to irreversible loss. Another concern is network congestion during peak hours, which might delay or affect the transfer’s finalization. Additionally, fluctuations in Bitcoin’s value can impact the transaction’s outcome.

Fees Associated with Bitcoin Transfers to Cash App

The fees associated with Bitcoin transfers to Cash App are influenced by various factors. These include the chosen exchange, the network fees, and potential Cash App transaction fees. It’s essential to understand these fees before initiating a transfer.

| Exchange | Network Fee (estimated) | Cash App Fee (estimated) | Total Estimated Fee |

|---|---|---|---|

| Coinbase | $5-15 | $0.50-1.50 | $5.50-16.50 |

| Kraken | $5-15 | $0.50-1.50 | $5.50-16.50 |

| Gemini | $5-15 | $0.50-1.50 | $5.50-16.50 |

Note: Fees are estimates and may vary depending on transaction volume, time of day, and other factors.

Alternatives to Cash App for Bitcoin Transactions

Beyond Cash App, numerous platforms facilitate Bitcoin transactions. Choosing an alternative depends on individual needs, including desired features, security protocols, and transaction fees. Understanding the various options empowers informed decisions when engaging with the Bitcoin ecosystem.While Cash App offers straightforward Bitcoin buying and selling, other platforms provide specialized services, advanced features, and sometimes, more favorable pricing structures. This exploration delves into these alternatives, providing a comprehensive comparison.

Alternative Bitcoin Transaction Platforms

Several platforms offer competitive alternatives to Cash App for Bitcoin transactions. These platforms cater to different user needs and preferences, ranging from basic wallets to sophisticated trading platforms.

- Coinbase: A widely recognized platform for buying, selling, and holding cryptocurrencies. Coinbase’s user-friendly interface and robust security measures make it a popular choice for both beginners and experienced traders. It supports various fiat currencies for purchasing Bitcoin. The platform offers a comprehensive range of tools for managing crypto holdings and navigating market trends. It’s also known for its educational resources.

- Kraken: Known for its advanced trading features, Kraken is often preferred by experienced traders seeking advanced order types and margin trading options. Kraken stands out with its sophisticated order book and robust API, enabling seamless integration with trading bots and algorithmic strategies. However, it may have a steeper learning curve compared to more user-friendly platforms.

- Gemini: A platform known for its emphasis on security and regulatory compliance. Gemini employs multi-factor authentication and cold storage solutions for safeguarding user assets. It is often considered a secure option for individuals prioritizing peace of mind in their crypto transactions. The platform is particularly attractive for those seeking regulated and insured services.

- BlockFi: BlockFi provides a platform that enables users to earn interest on their Bitcoin holdings. This unique feature stands out among other wallets and exchanges. BlockFi offers a variety of accounts with varying interest rates, allowing users to potentially earn passive income on their cryptocurrency investments.

Comparative Overview of Bitcoin Wallets and Payment Options

A variety of wallets and payment options are available for Bitcoin transactions, each with its unique characteristics. The selection process hinges on factors like ease of use, security measures, and specific features.

- Hardware Wallets: These wallets physically store private keys, offering an enhanced layer of security against online breaches. Examples include Ledger Nano S and Trezor Model T. Hardware wallets are often favored by individuals seeking to secure their Bitcoin holdings against cyber threats. These devices are considered a strong measure of security for cryptocurrencies. However, they can be more expensive and require a degree of technical knowledge to set up and use properly.

- Software Wallets: These wallets are installed on a computer or mobile device, enabling easy access to Bitcoin. Examples include Electrum and Exodus. These wallets are user-friendly and often provide a wide range of features, such as transaction history and portfolio management. They typically offer a lower barrier to entry than hardware wallets, though they may be more susceptible to hacking if not properly secured.

Security Protocols of Bitcoin Transaction Platforms

Security is paramount in the Bitcoin ecosystem. Robust security protocols are essential to safeguard assets and prevent unauthorized access.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security, requiring multiple verification methods (e.g., password, code from an app) to access accounts. This approach significantly enhances security by making unauthorized access more difficult.

- Cold Storage: Offline storage of private keys is considered a highly secure method to protect against online attacks. This approach limits exposure to vulnerabilities in online systems.

- Two-Factor Authentication (2FA): A popular security measure that necessitates two forms of verification to access an account. This significantly enhances security, as unauthorized access becomes much more challenging.

Summary Table of Bitcoin Transaction Methods

The following table summarizes different methods for sending and receiving Bitcoin.

| Platform | Receiving Bitcoin | Sending Bitcoin | Security Features |

|---|---|---|---|

| Coinbase | Direct deposit to wallet | Secure transfer via platform | MFA, cold storage, insurance |

| Kraken | Wallet deposit | Advanced order types, margin trading | MFA, secure API, two-factor authentication |

| Gemini | Wallet deposit | Secure transaction history | Cold storage, regulatory compliance, multi-factor authentication |

| Hardware Wallets | Offline access to funds | Offline signing of transactions | Physical security, offline storage |

| Software Wallets | Easy access via software | Transaction signing via software | MFA, regular updates |

General Information About Buying Bitcoin

Bitcoin, while offering exciting investment opportunities, is notorious for its price volatility. Understanding this inherent characteristic is crucial for any potential investor. Navigating the market requires not just a keen eye but also a strategic approach to risk management.The value of Bitcoin is highly susceptible to fluctuations, influenced by various market factors. These factors can range from regulatory announcements to technological advancements, news events, and overall market sentiment.

This dynamic nature necessitates a comprehensive understanding of market trends and analysis to make informed decisions.

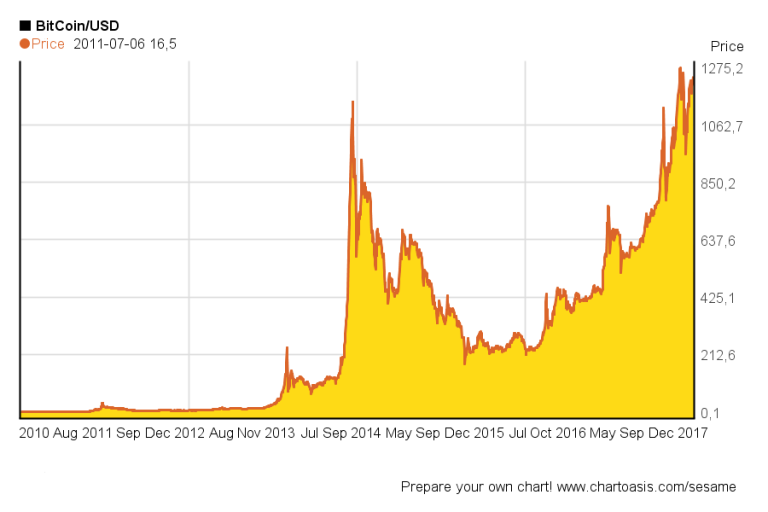

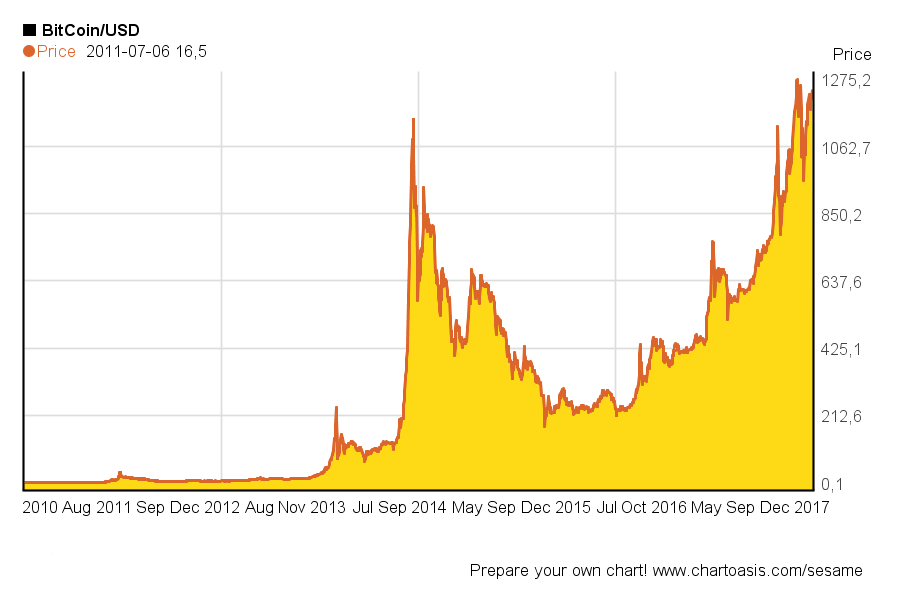

Bitcoin’s Value Fluctuations and Volatility

Bitcoin’s price can swing dramatically in short periods. This volatility stems from the decentralized nature of the cryptocurrency, which means it isn’t controlled by a central authority. Speculation, news cycles, and even social media trends can all contribute to these price movements. For instance, a positive news report about a major adoption by a corporation could cause a significant price increase, while a negative regulatory development could lead to a sharp decrease.

Understanding Market Trends and Analysis

Analyzing market trends is essential for mitigating risk and potentially capitalizing on opportunities. This involves studying historical price data, identifying patterns, and considering the broader economic context. Tools like charts and technical indicators can be used to analyze trends. For example, a rising trend in Bitcoin price might suggest a potential uptrend, but a sustained period of high volatility requires cautious consideration.

Fundamental analysis, focusing on Bitcoin’s underlying technology and adoption rate, can complement technical analysis to provide a more holistic perspective.

Strategies for Managing Risk When Investing in Bitcoin

Managing risk is paramount when dealing with Bitcoin’s volatility. One effective strategy is diversification, spreading investments across different assets. This can help reduce the impact of a single investment’s performance on the overall portfolio. Another key strategy is setting clear stop-loss orders. This approach involves defining a predetermined price point at which to sell the Bitcoin to limit potential losses.

Setting realistic expectations and practicing patience are also crucial. Bitcoin’s price movements are often unpredictable, and hasty decisions can lead to significant financial losses.

Legal and Regulatory Aspects of Bitcoin Trading

The legal and regulatory landscape surrounding Bitcoin varies significantly by jurisdiction. Some countries have embraced Bitcoin more readily than others, offering clear regulatory frameworks. Others may have stricter regulations or outright prohibitions. Understanding these legal and regulatory nuances is crucial before investing. Consulting with financial advisors and legal professionals is highly recommended to gain a comprehensive understanding of the local regulations governing Bitcoin transactions in a specific jurisdiction.

Historical Price Movements of Bitcoin

| Date | Price (USD) |

|---|---|

| 2010-07-17 | 0.003 |

| 2017-12-17 | 19,783.00 |

| 2021-11-07 | 67,000.00 |

| 2023-03-15 | 26,000.00 |

This table illustrates a sample of Bitcoin’s historical price movements. The significant price swings over time highlight the need for careful consideration of market trends and risk management. Note that this is not an exhaustive list and past performance is not indicative of future results. Data sourced from reputable financial resources.

Security and Risk Management

Bitcoin, while offering exciting investment opportunities, comes with inherent risks. Understanding and mitigating these risks is crucial for safeguarding your digital assets. A robust security strategy is paramount for navigating the complexities of the cryptocurrency landscape.

Importance of Secure Practices

Robust security practices are essential for protecting your Bitcoin holdings. Neglecting these practices can lead to significant financial losses. Implementing strong security measures not only safeguards your Bitcoin but also protects you from potential scams and fraudulent activities.

Security Measures for Bitcoin Holdings

To protect your Bitcoin holdings, a multi-layered approach is recommended. This includes using strong passwords, enabling two-factor authentication, and regularly monitoring your accounts. Using reputable and secure platforms for buying and storing Bitcoin is also vital. Employing strong passwords and enabling two-factor authentication significantly enhance security. Regularly updating software and using reliable antivirus software on your devices is crucial to prevent malware infections that can compromise your accounts.

Strong Passwords and Two-Factor Authentication

Strong passwords are the first line of defense against unauthorized access. Use a combination of uppercase and lowercase letters, numbers, and symbols. Avoid easily guessable passwords, like your birthdate or common phrases. Two-factor authentication (2FA) adds an extra layer of security by requiring a second verification method, like a code sent to your phone, alongside your password.

Activating 2FA significantly reduces the risk of unauthorized access to your accounts.

Risks Associated with Scams and Fraudulent Activities

Bitcoin, like any other financial asset, is vulnerable to scams and fraudulent activities. These scams often involve misleading promises of high returns or exploiting investor naiveté. Understanding these risks and practicing caution is essential for avoiding financial losses.

Common Bitcoin Scams and Fraudulent Activities

Many fraudulent schemes target Bitcoin investors. These schemes can take various forms, from phishing scams to fake investment opportunities. Understanding these schemes allows investors to avoid becoming victims.

| Scam Type | Description | Example |

|---|---|---|

| Phishing Scams | Fraudsters attempt to trick you into revealing your login credentials or private keys by posing as legitimate platforms or individuals. | Emails or messages mimicking official Bitcoin exchange platforms asking for login details. |

| Fake Investment Opportunities | Fraudulent schemes promising unrealistic returns on Bitcoin investments. | “Guaranteed” high-yield Bitcoin investment programs. |

| Pump and Dump Schemes | A group artificially inflates the price of a cryptocurrency and then quickly sells their holdings, leaving others with losses. | Rapid price increases of a cryptocurrency with little underlying value. |

| Malware and Virus Attacks | Malicious software that infects your devices and steals your Bitcoin or other sensitive information. | Hidden programs installed on your computer disguised as legitimate software. |

| Fake Bitcoin Exchanges | Scammers create fake platforms that look like legitimate exchanges. | Websites that mimic known Bitcoin exchange sites. |

Conclusion

In summary, buying Bitcoin and sending it to Cash App involves careful consideration of various factors. Understanding the different buying methods, platform features, and security protocols is key. This guide provides a solid foundation for navigating this process. Remember to prioritize security and research any platform before committing to a transaction.

FAQ Resource

What are the typical fees associated with sending Bitcoin to Cash App?

Fees vary depending on the exchange and Cash App’s transaction policies. Always check the specific fees with the platforms involved.

How long does it typically take to send Bitcoin to Cash App?

Transaction times depend on network congestion and the specific exchange and Cash App. It’s often a matter of minutes to a few hours.

What are some common scams related to Bitcoin transactions?

Be wary of unsolicited emails or messages claiming to help with transactions. Verify all information carefully and avoid sharing personal details with unknown parties.

Are there any regulations regarding Bitcoin purchases and transfers?

Regulations vary by jurisdiction. Always research the legal and regulatory framework in your region regarding cryptocurrency transactions.